If you rely on Medicare for your health insurance, then you’ve probably heard about Medicare Advantage and Medigap, which are types of supplemental insurance designed to cover medical expenses left after Medicare pays for a portion of your medical bills. If you’ve put off looking into these two supplements because you didn’t want to have the added monthly expense of more health care premiums, here are some things you should know:

If you rely on Medicare for your health insurance, then you’ve probably heard about Medicare Advantage and Medigap, which are types of supplemental insurance designed to cover medical expenses left after Medicare pays for a portion of your medical bills. If you’ve put off looking into these two supplements because you didn’t want to have the added monthly expense of more health care premiums, here are some things you should know:

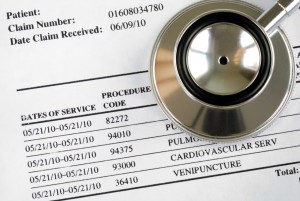

Medicare Supplement: You May Need More Financial Help With Medical Bills

Most people have some type of health issue when they get older, and the one they’re most likely to experience is cardiovascular disease. In fact, according to the U.S. Centers for Disease Control and Prevention, heart disease is the leading cause of death for both men and women in the United States. Coronary heart disease alone costs Americans over $108 billion per year in health care services, medications and lost productivity. If you add the other top causes of illness and death (cancer, strokes, diabetes and chronic respiratory diseases) the odds are that you’re going to get sick and need more help paying for medical bills than you can get from Medicare alone.

Medicare Supplemental Insurance: One Surgical Procedure Could Ruin You Financially

If you are one of the 1 in 4 Americans who develop heart disease, there’s a good chance you may require surgical intervention. One of the most common surgeries for coronary heart disease is a coronary artery bypass graft surgery (CABG), more commonly known as a heart bypass, and it isn’t cheap. A study by the American Heart Association concluded that the average cost of a CABG in the U.S. is around $151,000, with costs ranging anywhere from $44,000 to $450,000. If Medicare pays 80% of the bill, your share, if you had this surgery, would be around $30,000 and that doesn’t include medications, rehabilitation and after-care.

Medicare Supplement Insurance: Medigap Or Medicare Advantage Can Help

Both Medigap insurance and Medicare Advantage can help to defray the 20% of your medical bills that you are responsible for. Both have advantages and disadvantages in three significant areas:

Cost: Generally, Medigap plans have higher monthly premiums but lower out-of-pocket expenses than many Medicare Advantage plans. Medicare Advantage plans, on the other hand, usually cost less and cover more services.

Choice: Medicare and Medigap policies cover you if you choose any medical facility that accepts Medicare. In general, Medicare Advantage plans limit you to providers in their HMO or PPO and may not cover you if you go to an out-of-network provider.

Lifestyle: Because they allow you to choose any provider who accepts Medicare, Medigap plans are a better choice if you travel, in or out of the United States. Many Medigap policies will cover your medical expenses outside of the U.S. Medicare Advantage plans do not have this flexibility because you must stay within their network, so you’ll run the risk of being unprotected if you travel to a location that doesn’t have preferred providers available.

Contact the Benefit Link

To learn more about Medigap Medicare supplemental insurance, call us at The Benefit Link at (877) 805-2952 or visit us online at www.thebenefitlink.com. At The Benefit Link, our only interest is in helping seniors make informed decisions about their Medigap insurance choices.

Photo Credit: ©Depositphotos.com/ johnkwan